By 2050, India will experience a temperature rise of 1-4°C and rainfall will increase by 9-16 per cent. This will have a detrimental effect on farmers.

Sensitivity

12 states* have districts that are highly sensitive to climate change

Sensitivity is the degree to which a region gets affected by climate-related stimuli, such as climate variability and the frequency and magnitude of extremes events like cyclone and drought. It is determined by demographic and environmental conditions of the region. Most districts in north-western India are highly sensitive to climate change impacts. Eastern, north-eastern, northern and west coast of the country have relatively low sensitivity.

Exposure

Exposure

21 states* have districts that are highly exposed to climate change risks

Exposure is defined as the nature and degree to which a system is exposed to significant climatic variations. It includes parameters, such as maximum and minimum temperatures and the number of rainy days. High to very high exposure is observed in the districts of Madhya Pradesh, Karnataka, Rajasthan, Gujarat, Maharashtra, Bihar, Tamil Nadu, north-eastern states and Jammu & Kashmir. Districts with low exposure are seen in Andhra Pradesh, Odisha, West Bengal, Punjab, Haryana, Rajasthan and Uttar Pradesh.

Adaptive capacity

17 states# have districts with low adaptive capacity to climate change

Adaptive capacity is the ability of a region to adjust to climate change. It is a function of wealth, technology, education, skills, infrastructure, access to resources, and management capabilities. Adaptive capacity is found to be very low in the eastern and north-eastern states, Rajasthan, Madhya Pradesh, peninsular and hill regions. Adaptive capacity is high in Punjab, Haryana, western Uttar Pradesh and Tamil Nadu.

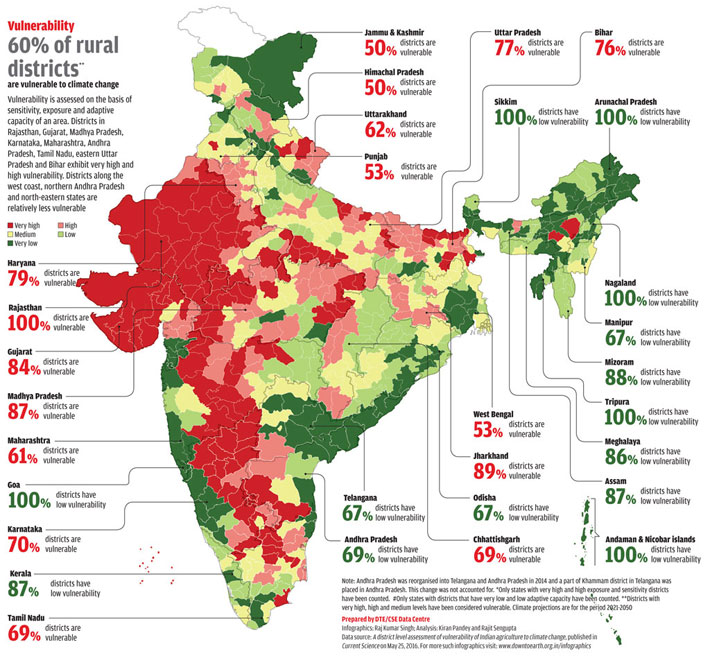

Vulnerability

60% of rural districts** are vulnerable to climate change

Vulnerability is assessed on the basis of sensitivity, exposure and adaptive capacity of an area. Districts in Rajasthan, Gujarat, Madhya Pradesh, Karnataka, Maharashtra, Andhra Pradesh, Tamil Nadu, eastern Uttar Pradesh and Bihar exhibit very high and high vulnerability. Districts along the west coast, northern Andhra Pradesh and north-eastern states are relatively less vulnerable