UPSC/STATE PSC

Curated by Experts For Civil Service Aspirants

The Hindu & Indian Express

News 1: Central Bureau of Investigation

- Central Government shall appoint the Director of CBI on the recommendation of a three-member committee consisting of the Prime Minister as Chairperson, the Leader of Opposition in the Lok Sabha and the Chief Justice of India or Judge of the Supreme Court nominated by him. (where there is no recognized leader of opposition in the Lok Sabha, then the leader of the single largest opposition party in the Lok Sabha would be a member of that committee)

4) The CBI is a multidisciplinary investigation agency of the Government of India and undertakes investigation of corruption related cases, economic offences and cases of conventional crime. It normally confines its activities in the anti-corruption field to offences committed by the employees of the Central Government and Union Territories and their public sector undertakings.

5) It takes up investigation of conventional crimes like murder, kidnapping, rape etc., on reference from the state governments or when directed by the Supreme Court/High Courts

News 2: Martand Sun Temple in Kashmir

Background: ASI had objected to the ‘Navgrah Ashtamangalam Puja’ on the premises of Martand Temple as it is a heritage site.

About Martand Sun Temple :

1) Built by the Karkota dynasty king Lalitaditya Muktapida, who ruled Kashmir from 725 AD to 753 AD. Kalhana in Rajatarangini mentions that the Martand Sun Temple was commissioned by Lalitaditya Muktapida in the eighth century AD.

2) According to Jonaraja, the temple was destroyed by Sikandar Shah Miri who is also known as Sikandar Butshikhan ( Butshikan is a title meant for ‘temple Destroyer’)

3) It is located near the city of Anantnag in the Kashmir Valley of Jammu and Kashmir.

4) It is the earliest known Sun temple in India.

Jonaraja:-He was a Kashmiri historian and Sanskrit poet. His Dvitīyā Rājataraṅginī is a continuation of Kalhana’s Rājataraṅginī and brings the chronicle of the kings of Kashmir down to the time of the author’s patron Zain-ul-Abidin (r. 1418-1419 and 1420-1470). Jonaraja, however, could not complete the history of the patron as he died in the 35th regnal year. His pupil, Śrīvara continued the history and his work, the Tritīyā Rājataraṅginī, covers the period 1459–86

News 3: India, Bangladesh ink first water sharing pact in 25 years

Background: India and Bangladesh recently signed an interim water sharing agreement for the Kushiyara river, the first such pact since the signing of the Ganga water treaty in 1996.

Details :

1) India and Bangladesh share 54 rivers.

2) Bangladesh Prime Minister Sheikh Hasina sought for an early conclusion of the Teesta water sharing agreement, which has been hanging for more than a decade due to opposition from West Bengal Chief Minister Mamata Banerjee.

3) Both leaders unveiled Unit-I of the Maitree Super Thermal Power Project. Being constructed under India’s concessional financing scheme, the Project will add 1320 MW to Bangladesh’s National Grid.

4) In total both the countries have signed 7 MoUs

Teesta River :

1) Initially it was part of Ganges system but after a flood, it has changed its course and joined the Brahmaputra river.

2) Tributaries

- Left bank:- Rangpo River, Lachung River, Ranikhola, Relli River, Talung River, Dik Chhu, Lang Lang Chu

- Right bank:- Rangeet River, Ringyong Chhu, Ranghap Chhu

Kushiyara River:

1) It is a distributary river in Bangladesh and Assam, India.

2) It forms on the India-Bangladesh border as a branch of the Barak River, when the Barak separates into the Kushiyara and Surma.

Barak River :-The Barak is the second largest river system in the North East India as well as in Assam. The Barak rises on the southern slope of the lofty Barail Range in Manipur and forms a part of the northern boundary of the Manipur State with Nagaland where it is known as Kirong. Near Karimganj, it bifurcates into the northern branh of Surma and the southern branch of Kushiyara

News 4: Shanghai Cooperation Organisation (SCO) summit in Uzbekistan

Background: China’s President Xi Jinping is likely to travel to Kazakhstan on September 14 and subsequently attend the Shanghai Cooperation Organisation (SCO) summit in Uzbekistan on September 15 16.

About SCO :

1) It is an intergovernmental organization which operates in Eurasian political, economic and military arena aiming to maintain peace, security and stability in the region.

2) Prior to the creation of SCO in 2001, Kazakhstan, China, Kyrgyzstan, Russia and Tajikistan were members of the Shanghai Five.

3) Following the accession of Uzbekistan to the organization in 2001, the Shanghai Five was renamed the SCO.

4) India and Pakistan became members in 2017.

5) Head Quarter:- Beijing

6) India, which would take over the SCO Presidency next year, would give the fullest support for the success of the Samarkand Summit in Uzbekistan in September 2022.

News 5: Purchasing Managers’ Index

1) The PMI is based on a monthly survey of supply chain managers across 19 industries, covering both upstream and downstream activity.

2) The questions are related to 5 key variables. The variables with their weights in the index are — new orders (30%), output (25%), employment (20%), suppliers’ delivery times (15%) and stock of items purchased (10%). The surveys are conducted on a monthly basis.

3) IHS Markit produces the PMI for India. The IHS Markit India Manufacturing Purchasing Managers’ Index measures the performance of India’s manufacturing sector.

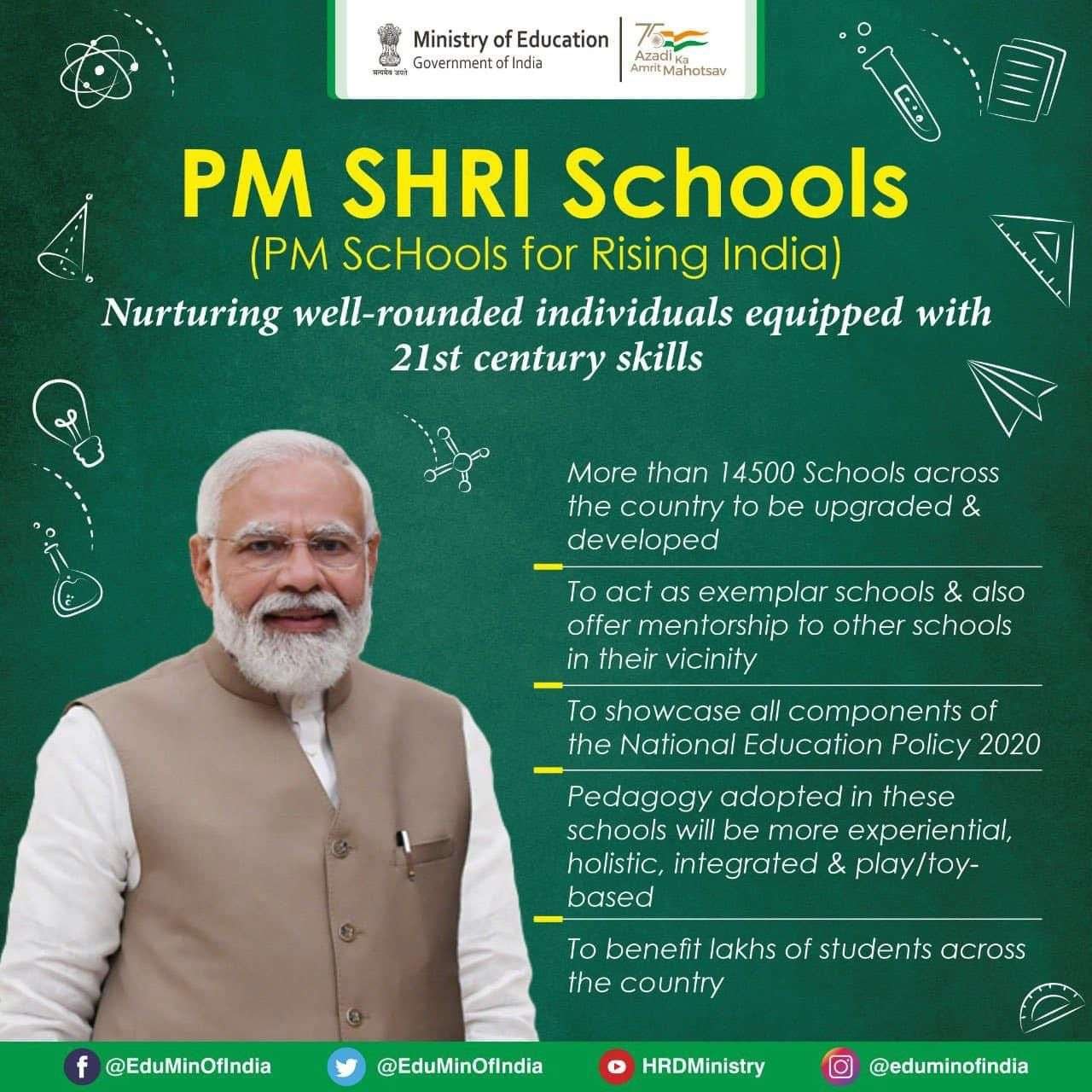

News 5: PM SHRI (PMSchools for Rising India)

1) Under it, as many as 14,500 schools across states and Union Territories will be redeveloped to reflect the key features of the NEP, 2020.

2) Kendriya Vidyalayas or Jawahar Navodaya Vidyalayas come entirely under the Centre’s Ministry of Education. They are fully-funded by the Union government under Central Sector Schemes.

3) While KVs largely cater to children of Union government employees posted in states and UTs, JNVs were set up to nurture talented students in rural parts of the country.

4) In contrast, PM SHRI schools will be an upgrade of existing schools run by the Centre, states, UTs and local bodies. This essentially means that PM SHRI schools can either be KVs, JNVs, state government schools or even those run by municipal corporations.

One Liners:-

1.

2.THE ICONIC Rajpath from RashtrapatiBhavan to IndiaGate is all set to be renamed as Kartavya Path (Path of Duty)