Ken-Betwa river-linking project faces new hurdle

A new hurdle has come in the way of the Ken-Betwa river interlink project in its terms of financing. The NITI Aayog (National Institution for Transforming India) has recommended that Madhya Pradesh contribute 40% of the project cost, with the Centre contributing 60%. The Ministry of Water Resources (MoWR) has opposed this and requested that 90% of the funds be routed through the Centre.A lack of clarity on the funding pattern could mean more delays to the Rs. 10,000-crore project that would be the first ever inter-State river interlinking project.

The project was given a go-ahead by the National Board for Wildlife (NBWL) last August. An environment clearance panel has also cleared the project.

For The First Time Ever, ISRO To Launch 103 Satellites On A Single Rocket

The Indian Space Research Organisation (ISRO) is aiming for a world record by putting into orbit 103 satellites – three Indian and 100 foreign – on a single PSLV-C37 rocket in February 2017, the agency informed on Wednesday (4 January). The previous world record is held by Russian rocket Dnepr, which launched 39 satellites at one go in June 2014.

Earlier, the plan was to launch 83 satellites (80 foreign) on a single rocket in the last week of January. But with the addition of 20 more foreign satellites, the launch was delayed by a week and will now take place in the first week of February.

Foreign satellites weigh 500 to 600 kilograms and belong to seven countries – Israel, Kazakhstan, Netherlands, France, Germany, Switzerland and the United States. The three Indian satellites are Cartosat-2 series, weighing 730 kg as primary payload, and INS-IA and INS-1B, weighing 30 kg.

The major challenge for the proposed mission is to hold the rocket in the same orbit till all the satellites are ejected. As all the 103 satellites will be put in a single orbit, the rocket will not be switched on and off.

For ISRO, the launch of multiple satellites at one go is not a new thing as the agency has undertaken several such missions in the past. Setting a record in June, the agency had successfully launched 20 satellites, including its earth observation Cartosat-2 series, in a single mission on board PSLV-C34.

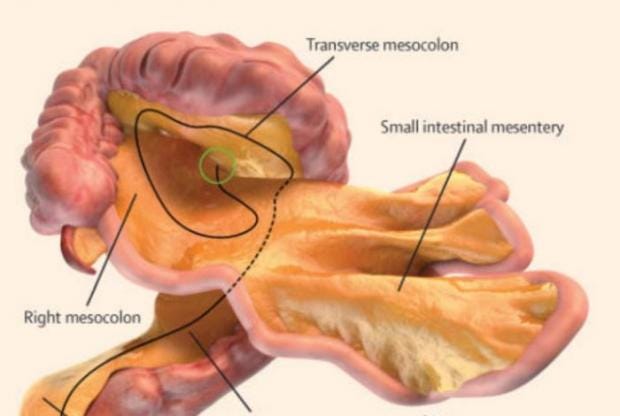

Mesentery, the New Organ Discovered in the Human Body

- Irish scientists have recently identified a new human organ that has existed in the digestive system for hundreds of years.